Photo by Luke Chesser

As 2019 draws in, my blog this month is a self-reflection that I wanted to share with you and my thoughts that may hopefully help motivate you into the new year with some goals of your own.

Firstly in 2019, I had two goals alongside my full-time goal of trying to maintain my health and wellbeing; one, to finish my masters and two, to start a side hustle to create some passive income long term when I am hopefully lucky enough to retire. I then gained a third, being the best Chief Bath Bomber in the world. 🙂

Retire? I hear you say, surely that word means you’re at the end of a long life after decades of working very hard. Well, not when you’re aiming for FIRE! I’ll tell you now, achieving FIRE is hard. By now, like me, when I first encountered FIRE on a podcast studying for my MBA – I know you’ll be thinking what on earth is he on about? What does FIRE stand for?

What on earth is Financial Independence Retire Early (FIRE)?

In a nutshell, amongst all the complex things you will find online about FIRE, I have learned it is about three things;

- Minimising your monthly expenses

- Maximising your monthly incomes

- Generating passive incomes to cover your monthly expenses

If you do this, entirely for all expenses, income and passive income you have reached FIRE!

Sounds simple doesn’t it and common sense? Well, like me and most people I worked all the way through my 20’s and spent my money buying clothes, mobiles, holidays and going out socialising etc. We’re stuck in a capitalist cycle of earning and spending – and let’s be honest our monthly expenses totally exceeded our monthly income. To make things worse we get debt, for a mortgage, car and at least a credit card. I don’t regret my 20’s though as I lived it to the best I could – but what if somebody had told me about FIRE at 19? Would I have done something differently? I wish I was taught this at school. So for all you teacher’s or curious people out there you must download the Your Money Matters – A Teacher’s Guide funded by Martin Lewis, founder of Money Super Market.

It seems silly in your early 30’s to really think about retiring when you’ve probably (if you’re lucky enough) only just got a mortgage and maybe a car – but it is very possible. Primarily if you can change your capitalism approach to life.

Argh, the tricky and complex bits about FIRE

Secondly, if you’re interested in FIRE (or even RE – retire early, which we all dream of) the complex bit is taking stock, of it ALL! Adding everything up, being honest with yourself and get to your ‘net worth’. It is very sobering when you’ve worked since you were 15 to see just how little your net worth is and how much time you have put into it. Then working out how much time you have spent working for that?

It’s scary and daunting, but I did this and for better or for worse it has changed my complete perspective on life, money and time. I read two books which helped me work through the above and it changed my perspective. Even if you’re not interested in FIRE they are great reads and I can assure you it will change your perspective from reading these. If you have retired already (well done ya lucky bugger), the first one is a good reminder of how precious our time is.

I’m not going to the extreme with FIRE as I like socialising and speaking to and meeting new people as it is important for my mental health – but some people have made significant sacrifices to monitor every penny spent. I’ve learned it’s about a balance and focusing on what is important to you in life.

In Your Money or Your Life, the concept of trading your ‘life energy’ for money is powerful. I realised for me it’s my time, I want it back whilst I am lucky enough to be healthy! You don’t need to be a financial accountant to understand that if you have higher expenses each month above your incomes, you’re going to be in trouble though, so in this world, it’s hard to navigate to get your time back.

The concept is about working all the time and then spending that money on an item, I believe it will significantly change your outlook on life. How much of your life energy will you need to use to buy a TV? I will spare you all the crazy FIRE movement ideas out there, as there are some very smart people out there retiring in their twenties without living a ‘frugal’ life as most media outlets report, an example is below;

I would, however, take a moment to scroll through Mr Money Moustaches website, who I admire greatly and envy his outlook on life. It is a great scroll through and I’m sure you will take something away from it, what an absolute legend?!

Also, in my blog on 5 reasons why handmade gifts supercharge your mental health this new approach I’m adopting which stemmed from FIRE has actually led me into making handmade bath bombs. In my blog, I said I thoroughly enjoy making them and the process significantly improves my mental wellbeing by putting down all my devices and focusing on making something that people have been willing to trade with me and support me. This is a very humbling feeling I am so grateful for. This has become my side hustle, one of my chosen routes to help me achieve FIRE. There are many other forms such as investments or property rentals but my dream took me here with zebomb Bath Fizzers.

What on earth is a side hustle?

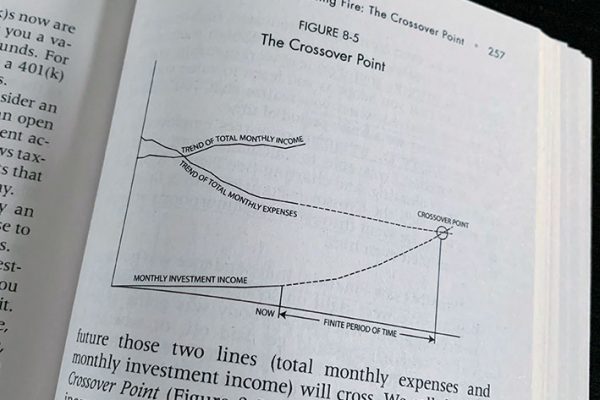

Finally, in reality, young people like me have to work. We can’t retire that early, my formal pension age here in the UK is 68 (if I’m fortunate enough to make it)? I want my ‘life energy’, I don’t want to trade my ‘life energy’ for money through working until I’m 68. But we have mortgages and student loans to pay off for starters in England. But what if, as you grow you start to plot a graph of points 1, 2 and 3 above each month and yearly?

When point 3 (your passive income) passes point 1 (expenses) on the graph this is known as the ‘cross-over’ point to FIRE. The holy grail where your passive income exceeds your monthly expenses. You still with me? Good. As zebomb Bath Fizzers is my side hustle, this is only one channel from many ways to create long term passive income. I now believe on reflection that my dream I’ve mentioned in ‘My Story’ was because of all my research into FIRE. My simple two goals I set in 2019 have significantly changed my life, who knew this would happen?

If you want to learn about an extreme side hustle, Carol Kubicki is a travel writer and living in a campervan, wow! I certainly could not do this or advocate this one but she’s another legend for achieving this.

How are you feeling now? I remember when I first understood FIRE how it completely annoyed me and thought yeah right! But then it motivated me to learn more and if this could be achievable for me. As well as how on earth do I get my ‘life energy’ back? I will never get this back. It’s time to reflect and think about what matters to you most and set some goals for the new year and just go for it. Mine are simple, visit as many lakes in the UK for each of my bath bombs as possible and improve my Yoga. Let’s see where this takes me in time for next years blog!

Who knows where it will lead you, zebomb has taught me so much and I have met some fantastic people and appreciate all the customers who are trading with me for my handmade products which I’m really proud of. My new CBD range is now also helping others with various conditions and the feedback has been overwhelming which is a further example of great things that can come from goals. Please do tap over to my Shop and check out the bath bombs and I hope you have a wonderful year ahead of you.

Thank you.